Bitcoin has a Brand Problem

Bitcoin taught me to save differently — but lately, I’m questioning its image. A reflection on branding, politics, and why fixing the narrative matters more than ever.

DiPartures is my chance to write about things apart from my SoEV project which has thankfully brought most of my readers to this Substack. This is my second time now publishing about Bitcoin.

If you are new to this Substack, you can check out my other sections INS(oev)IDE, where I write about the stories of being a street photographer and some commentary on clothing and style or GENEs, interviews about clothing.

This is another long one, and was mostly written as a way for me to grapple with how I am currently thinking about what is going on in the space.

I. Introduction

A few months ago, I wrote a piece on Substack called “What Bitcoin Taught Me.” In many ways, it was a love letter to everything Bitcoin has taught me over the past four years — from understanding financial markets to simply becoming better at saving money. It’s not something I usually talk about publicly, so I was nervous to publish it.

The piece had decent engagement, reaching more than 500 readers and sparking a handful of thoughtful DM conversations. It wasn’t overly controversial. For those new to Bitcoin, it likely resonated as a personal story about money and millennial financial struggle. For those already into Bitcoin, there probably wasn’t much they hadn’t heard before.

What interests me now, though, is the third group — the people who are aware of Bitcoin, but continue to resist it, sometimes passionately. I’ve spent a lot of time thinking about this, and I’m starting to notice that the reasons people are turned off may go beyond the usual tropes — Silk Road, volatility, crime, cypherpunks. There’s something deeper at play.

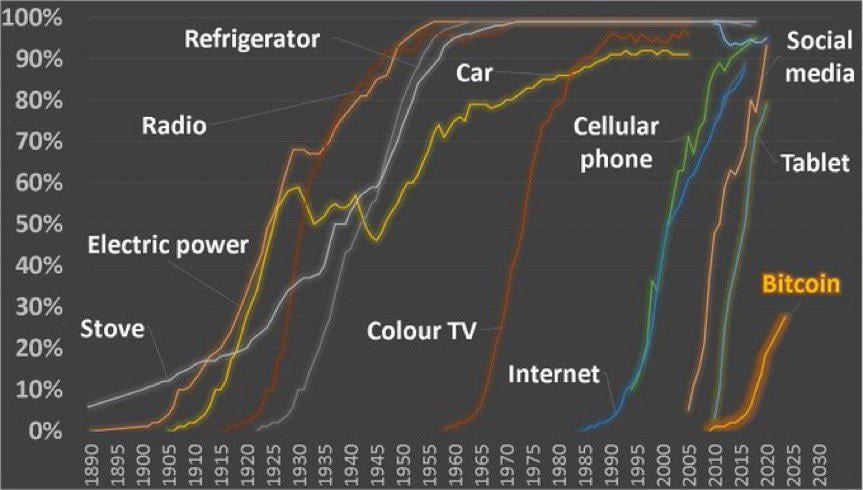

One of the main arguments of Bitcoins inevitable success in the future is the fact that many people claim it is following the “hockey stick model” of adoption curves, similar to the television, the internet, or smartphones. These arguments, often made by the Bitcoiners, who, I argue as the fourth group I’d like to discuss in this piece, don’t pay enough attention to the aforementioned “third group” above to actually let this play out.

For example; a couple months after publishing my Bitcoin-focused article, Vancouver’s Mayor, Ken Sim, announced that the city would begin exploring ways to become more “Bitcoin-friendly.” The announcement was met with widespread skepticism. I (regrettably) found myself in a Reddit thread on r/Vancouver, arguing with strangers — not because I’m a Ken Sim fan, but because I support the idea of Bitcoin adoption. The backlash was intense: resistance, misinformation, and a lot of knee-jerk anger.

As I continued to read and listen to conversations around nation-state adoption, corporate balance sheet strategies, and institutional buying, one question kept coming back:

Why are so many people still resistant to Bitcoin?

In my view, Bitcoin is arguably the most important financial invention of our time. But maybe... its brand is just a mess.

If Bitcoin is secure, scarce, decentralized, and increasingly adopted — why do so many people still misunderstand or reject it? Even if you don’t believe in those aspects, compare it to any financial asset since the beginning of Bitcoin, and it’s likely out-performed it (yes, past performance does not guarantee future results, but it’s hard to argue that it hasn’t done extremely well). I am, of course, aware that unlike a corporation; no one company, social media firm, or marketing department runs the Bitcoin narrative. I believe this is more of a strength than a detriment as I buy into the idea that no one entity should be in control of the money, and it is up to the people to maintain this decentralized ledger of a global monetary layer. But, the fact that there is no one driving the ship, means that sometimes the loudest voices, are the ones tied to the name of Bitcoin, whether we like it or not.

For average consumers, it often comes down to narrative.

In this article, I want to explore that narrative — where it came from, why it’s being reinforced, and why I believe Bitcoin continues to face an uphill battle in reaching widespread adoption.

Continuing on the Ken Sim example above, The Tyee, a left-leaning publication in Vancouver published an article shortly after called “Ken Sim’s Bitcoin Boosterism Is on the Ballot,” and its opening paragraph reads:

“Vancouver Mayor Ken Sim carefully cultivates a tech-bro image: T-shirts, headset mics, and an exercise bike at work. His current cheerleading for cryptocurrencies is very much on-brand.”

Later:

“Voters should think long and hard before giving Sim a mandate to spend any real money on this risky gimmick.”

And then:

“This mining uses incredible amounts of electricity: close to 200 terawatt hours last year globally, equivalent to the total power consumption of a medium-sized country. Sensitive to their growing reputation as polluters, crypto firms pledge to adopt cleaner sources of energy, but that’s greenwashing.”

By the end, there’s even a full section tying Bitcoin to “Trump’s corrupt crypto ties”, yikes.

Now, I could unpack each of these claims and respond with the nuance they deserve — and maybe I will at some point in an entirely different article. But instead, I want to focus on the broader thesis of this article:

Bitcoin has a brand problem. And if it can’t reach everyday people, it will never reach global adoption.

If you're a Bitcoin Maximalist, your knee-jerk response might be, “It doesn’t need mass adoption — nation-states, corporations, and BlackRock are in now” and really, the rest of this writing is for you. If you’re the “I agree with everything written in the Tyee”, then maybe start with my previous article.

Here’s my counterpoint to the Maxi’s:

Even the adoption curves that Bitcoiners love to cite — cell phones, the internet, televisions — all succeeded because they eventually reached everyone. Sure, they faced doubters early on. But their appeal grew, and the companies driving them figured out how to reach the masses. They hit escape velocity.

Bitcoin isn’t there yet. And with the people currently steering its public image, I’d argue it may take longer than many expect.

Perception shapes adoption. And adoption shapes destiny.

Bitcoin doesn’t just have a branding issue. It has a perception crisis — one that’s pushing people away before they ever get a chance to understand it.

II. Political Entanglement and the Freedom Paradox

As I mentioned in the introduction, soon after I finally took the plunge and publicly professed my interest and appreciation for Bitcoin, the political alignments and motives started to muddy my perception.

I’m a big fan of Bitcoin (obviously), but maybe I am holding it as an ideal image in my own mind as I’ve become more and more entrenched in learning about it from the strongly opinionated community.

Lately, I’ve had to ask myself a difficult question:

Why are so many of Bitcoin’s loudest supporters the people I least want to be aligned with?

Trump. Bukele. Putin. Musk, Ken Sim.

These are, for better or for worse, what the general public sees as the faces of Bitcoin right now.

Every time I see the Trump name tied with Bitcoin or “crypto” it kills me — not because I doubt the protocol, but because I know what that does to the “brand”. It reinforces the idea that Bitcoin is just another plaything of the powerful. Another tool for grifters and strongmen to spin their image. Bitcoin already has enough trouble shaking its shady past that many continue to cite as its drawbacks and reasons not to adopt it. Bitcoin’s early history doesn’t help. It was born in the shadows — with anonymous developers, a pseudonymous founder, and an underground culture of Cypherpunks and privacy maximalists. An image I personally find inspiring, but many may find troubling. Add in the Silk Road, the Mt. Gox collapse, the Sam Bankman Fried fiasco and years of headlines tying Bitcoin to crime, hacks, and scams — and that’s how the mainstream got introduced.

Most people never updated their understanding after that first impression and won’t if the image continues to be attached to these polarizing individuals.

If your first exposure is Trump talking about “mining the rest of the Bitcoin in America” or Bukele waving a flag while silencing dissent — you’re probably not going to download a wallet and start experimenting with Lightning, especially if you already hate those people.

A bit more on Trump… his name, and his son's name, is now tightly tied to crypto…and unfortunately (to me) Bitcoin. Whether it's through self-serving endorsements, rumored “strategic reserves,” or ugly attempts to launch NFTs and “crypto coins,” it’s clear he sees Bitcoin as a political and cultural tool — not as a decentralized revolution. Let’s not forget, the man bankrupted many casinos…CASINOS. You cannot tell me he understands the first thing about tokenomics, seed phrases, multi-sig, or the beauty of a decentralized network. Let’s not forget, the strategic reserve is currently being funded by seized assets…how “free” is that. When will they start finding political opponents and opinionated dissidents and seizing their assets to add to their SR, that would be a “budget-neutral” approach…wouldn’t it? My question continues to be, what will that do to public perception?

I get why Bitcoiners love to see Bitcoin on the main stage and seeing the POTUS speaking about Bitcoin. This was something they could have never imagined even four years ago. But, it has become oxymoronic to me to continue hearing Bitcoiners talk about “freedom money” and simultaneously back Trump's policies, while he pulls the most anti-freedom moves in history, socially speaking. Mass deportations without due process, expansion of detention facilities, the erosion of civil rights protections, and the suppression of political dissent don’t sound very “freedom” to me at this point.

Then there’s Nayib Bukele, who at one point was the poster child for Bitcoin’s potential. Young, slick, forward-thinking. He framed Bitcoin as a path to freedom. But now? He’s imprisoning innocent people — including Americans — without due process, and cozying up to Trump like a loyal apprentice. He also reverse course with regards to Bitcoin to cozy up to the IMF again. What happens when it turns out that he is taking payment for these prisoners from the USA in Bitcoin? Yikes.

The golden child for Bitcoin has become Trump’s little sidekick and it threatens the narrative.

The argument I hear mostly when I interact with the American Bitcoiners who back Trump is often “Bitcoin is for everyone”, which I definitely agree with, and understand, but what I think the nuance that they are missing is that “everyone” won’t be coming onto the network if it continues to be associated with these increasingly violent and oppressive regimes which we are seeing to rise quickly. My read on it currently is that the American Bitcoiners want to see Bitcoin succeed in their country so much that they are willing to settle with some chaos in the interim. There is also a “wishing for New World Order” that may be the undercurrent. Sitting comfortably on their stack of Bitcoin, they are willing to see things get shaken up to hopefully weather the storm and see orange skies on the other side of all of this.

You have to imagine what that does to the general public's perception of Bitcoin, though. Maybe if people were starting to come around to the idea after a few cycles that this in fact is all it's cracked up to be, the simple fact that it is tied to these politicians could harm its core mission. It’s a terrible look. Especially for a network that’s supposed to be about sovereignty, transparency, and resisting authoritarianism.

The Bitcoin community is one of the most passionate and focused groups I’ve ever witnessed, but I am afraid it may end up being a downfall if it continues to only be focused on “winning” without being focused on how and why it’s winning.

A Crisis of Representation

The issue here isn’t just about politics. It’s about representation.

It’s about who gets to speak for Bitcoin but more importantly, who gets heard.

Since there is no one in charge, it’s seeming like, at least to me, the wrong people have become the spokespeople, which makes me second guess my own interest and involvement in the project. I’ve always been someone to purchase and invest with morals and personal integrity, so what does that mean for this?

There are many different groups of people involved in telling the narrative of Bitcoin.

On one side, we have the grinning authoritarians adopting it to break free from the international monetary system and meme-fueled libertarians taking selfies of their steaks, raw milk, and guns.

On the other: thoughtful developers and teachers, community advocates, climate-focused technologists… but the latter don’t trend.

Before Trump and Bukele, Michael Saylor has been able to elevate above as the “poster boy”, quoted and interviewed on CNBC and Fox News, but I bet most people still don’t know who he is, and contrary to what many Bitcoiners think, I don’t see him as the best example. To an average person, he comes off as arrogant, and he often accelerates into complex financial jargon within the first few minutes of any interview, leading people to tune out. Not to mention, his first foray into market manipulation in the early 2000’s leading to a large fraud charge against him.

Meanwhile, on the complete opposite end of the spectrum, the people I admire outside of Bitcoin — creators, educators, journalists — continue to dismiss Bitcoin outright. Hank Green, someone I’ve respected for years, has publicly mocked it multiple times. The New York Times — a publication I otherwise respect — seems to go out of its way to dunk on Bitcoin, especially on the Hard Fork podcast. There’s a reflexive hostility there that feels personal.

And again, I get it.

Because when your first exposure to Bitcoin is filtered through headlines about Silk Road, money laundering, ransomware, boiling the oceans, or now Trump and Bukele — of course you’re going to be skeptical.

For millions, Bitcoin still feels shady — not because it is, but because that’s the story they were told.

This isn’t a critique of the tech.

This is a critique of the brand.

And if we want the Bitcoin ethos and monetary system to reach the people — not just the people who already own it — we need a better cultural frame. One that doesn’t rely on billionaires, strongmen, or memes to tell the story.

Again, to truly reach the upward part of the adoption curve, we need to actually make “Bitcoin for everyone”.

III. The Myth of Inevitable Adoption

Let’s start with a common mantra from the loudest voices in the Bitcoin space:

“It doesn’t matter what the public thinks anymore. Nation-states are adopting it. Institutions are buying. The game is already won.”

This idea — that Bitcoin adoption is inevitable simply because the "right people" are now on board — is gaining traction in Bitcoin circles. And I get the appeal. It’s comforting. It allows you to tune out critics, ignore public skepticism, and dismiss the messy work of education and outreach. There’s also an air of superiority baked in — as if we’ve evolved past needing to explain ourselves.

We take comfort in being the “early adopters.” Memes on Reddit and Nostr regularly echo the sentiment of “we’re so early,” often tagging posts from years ago when the price was lower and the skepticism just as high. The implication is that everyone will eventually bend the knee, once they see the orange light.

But here’s the problem: for it to be truly globally adopted, we need everyone to own it and use it.

If Bitcoin’s endgame is to be a global, censorship-resistant currency or a truly distributed store of value, then it doesn’t matter how many hedge funds are holding it. It doesn’t matter how many governments announce pilot programs. If the average person doesn’t understand it, trust it, or know how to use it — the revolution doesn’t happen.

ETFs have done a great job giving regular people exposure to Bitcoin’s upside — at least in theory. But if those same people aren’t holding actual Bitcoin, exchanging it with others, or understanding how it works as money, then it just becomes another Wall Street product. One more asset class traded by the 1%, out of reach and disconnected from its intended use case.

Holding isn’t using

Yes, BlackRock is in. Yes, MicroStrategy is all-in. USA talking about a strategic reserve, Bhutan, Kenya, Nigeria, Ethopia, all mining Bitcoin. But buying and holding Bitcoin isn’t the same as integrating it into daily life. The same goes for El Salvador making it legal tender. The headlines were exciting. But have the people of El Salvador widely adopted Bitcoin in practice? Not really. Most still use dollars. With 8 out of 10 people not even owning it. The same is true for institutions — the play is speculative. Strategic. My issues with the USA and El Salvador being at the helm of the conversation will be explored further in the section below.

Bitcoin may be reaching the balance sheets of the world. But it’s still far from people’s wallets.

What adoption actually looks like

Smartphones, the internet, credit cards didn’t win because the elites used them. They won because they became intuitive, accessible, and culturally normalized. Adoption wasn’t just technical — it was emotional, social, and behavioral.

That’s what made the curve bend.

So when I hear people say mass adoption no longer matters, I push back. Not because I want Bitcoin to stay underground — but because I want it to work. And for it to work, it has to reach people who have never heard of Michael Saylor or Jack Mallers.

Those of us already “in” tend to amplify each other’s voices, creating echo chambers like Nostr — a social network built around Bitcoiners. While there’s value in community, these platforms often reinforce insularity. They celebrate orange-pilled purity while continuing to put up walls, steeped in memes and maximalist culture, rather than reaching out. I consider myself “one of them”, but often feel like it’s commenting and writing into a space that is only tuned for one or two key topics, everything else just gets sent into the abyss.

Recently, there was a video posted talking about how Nostr is the best way to get people onto the Bitcoin network, as it’s a “first taste” of Bitcoin when the content you post gets zapped some satoshis, rather than liked. And while I agree with the sentiment, this creator obviously has not entered into Nostr as a novice. I have been trying for months to generate some content, speak to like minded people, and most some of my art, but my reach has not gone anywhere, and I would assume for anyone else outside of the Bitcoin community trying to come in for the first time, they would feel lost or disinterested with what is currently being talked about and posted on that platform.

That all being said, we’re seeing real adoption in places where it’s needed most. In the Global South, where fiat currencies have collapsed, Bitcoin has been a lifeline. In parts of Africa, companies like Gridless are powering entire communities with Bitcoin mining infrastructure.

There’s also the incredible work of the Human Rights Foundation, which funds developers and tools that help activists in authoritarian regimes use Bitcoin to receive donations, pay salaries, and transact without fear of censorship. In places like Nicaragua, Nigeria, China, and Russia, Bitcoin isn’t a speculative bet — it’s an escape hatch.

“The Bitcoin Development Fund (BDF) is dedicated to supporting individuals and projects that make Bitcoin and related freedom technologies more powerful tools for human rights defenders operating in challenging political environments.”

These are powerful examples, and provides me with hope that it can do the work it is advertised that it has the ability to do. These are the stories I’d like to see covered more, and these are the types of projects that continue to give me hope that Bitcoin can actually change the world for the better.

Jack Dorsey, quietly right

I have many examples of people in the space who continue to inspire me, many which I mentioned in the first bit of writing. Lately though there’s one person who seems to understand the bigger picture in the same way I am seeing it and has been vocal about it and has received some pushback. Jack Dorsey. He’s spent years quietly pushing for Bitcoin adoption at the grassroots level — not by shouting “have fun staying poor,” but by building actual tools and businesses focused on Bitcoin. Cash App made buying Bitcoin feel as casual as buying coffee and the newest project “Ocean” is aiming to continue to push the decentralization of Bitcoin mining.

Dorsey recently said something that perfectly captures this tension. In a podcast interview, when asked what could cause Bitcoin to fail, he replied:

“I think it has to be payments for it to be relevant… otherwise it’s just something you kind of buy and forget and only use in emergency situations or when you want to get liquid again.”

He went on to say that Bitcoin can still fail — not by being hacked or banned — but by becoming irrelevant. And the only thing that keeps it relevant, in his view, is making it usable for everyday payments. Simple, fast, accessible tools. Real competition for Visa and Mastercard.

In other words: Bitcoin’s survival isn’t guaranteed by speculation. It’s earned through utility.

And right now, that utility isn’t where it needs to be — not yet.

V. Why the Masses Still Don’t Get It

The last major hurdle I see — and maybe the biggest one — is the multi-peak challenge of educating people on Bitcoin, which, thankfully there are always many people thinking about and working on, but I thought I would explain my own views on it here.

Most of the solutions I see today, such as The Bitcoin Way and Onramp are usually focused on high net-wealth individuals or companies looking to add Bitcoin to the balance sheet. For us “regular folk”, we often rely on hearing about it through the grapevine, maybe catching something on TV, from a friend, or on Reddit. Again, reinforcing my point that the current “entry points”are shrouded in bad branding.

Entering into the space is overwhelming for even the most astute

It’s not just about explaining money. Or explaining tech. It’s about catching someone at the intersection of two very difficult spaces:

They have to already be questioning how our financial system works.

They have to not get overwhelmed by the technical layer Bitcoin requires.

That's a small Venn diagram overlap — and it's getting even smaller.

With more and more people living paycheck to paycheck, convincing them to invest in a “new monetary system” is a tough sell. Most people aren't looking for revolution. They're looking to pay rent next month. The pitch for Bitcoin — sovereignty, decentralization, hard money — sounds abstract when you’re staring down bills and inflation.

And even if someone is curious, they run headfirst into the second wall: tech overwhelm.

Bitcoin demands more of you than most systems. Memorizing seed phrases. Managing private keys. Understanding wallets, nodes, and block confirmations. All which are not necessary if you are simply going to buy an ETF, but as I mentioned above, the ideal scenario is everyone on the network. Most people struggle just remembering their Netflix password. Now we’re asking them to be their own bank? To master personal custody? It’s daunting — and it stops a lot of potential adopters cold.

Even the communities that should be onboarding newcomers — like Nostr, or the Bitcoin subreddit — often feel closed off. There’s still a culture of arrogance, memes, and inside jokes. Instead of welcoming the curious, it sometimes ridicules them.

The irony is brutal: Bitcoin is supposed to be for everyone. But today, it still feels like it’s for insiders.

VI. Case Study Outro – Even Great Products Can Have a Bad Brand

This branding problem isn’t unique to Bitcoin.

Even great products, built on strong fundamentals, have struggled because of poor branding — or worse, because of the wrong faces representing them. Of course, this being a “fashion” focused Substack, I couldn’t help myself and think of a few examples in the clothing world which may display the same journeys.

Take Crocs, for example.

They were mocked endlessly in their early years — symbols of ugliness and poor taste. It wasn’t until they leaned into the weirdness, owned their identity, and collaborated creatively that Crocs became cool again. Maybe it was bound to happen because of nostalgic fashion cycles. Maybe it was good corporate structure and marketing, but at the end of the day; same product, different narrative.

Or American Apparel.

Their fundamentals were incredible: made-in-USA, sweatshop-free clothing. But the company’s public image was tainted by scandal, bad leadership, and toxic branding. Great mission. Terrible messengers.

Or Patagonia.

It took decades for their mission — sustainability, environmental activism — to not only make sense to the public, but to resonate culturally. They stuck with it, slowly building trust until their brand became synonymous with quality and values.

A popular image on the Bitcoin subreddit is often old headlines mocking the early internet or cellphones, and feeling comfort in the fact we feel we are in the early innings, and we all know how those two turned it. But, think about how Apple approached the cellphone, making it a multi-tool, an irresistible piece of technology that you could not live without.

Will Bitcoin be able to do the same?

CONCLUSION

So what am I proposing? I am not overly sure, this was mostly a therapeutic exercise to write about how I am dealing with my own thoughts about Bitcoin, and maybe to generate some conversation.

There are lots of people, building very complex things, like bringing mining to Africa to use stranded energy and electrify the entire continent and solving super difficult problems, like how to scale the Bitcoin network for 8 billion people, or protect it from advances in quantum technology.

But at the end of the day, will those issues ever be issues, if it does not reach a vast majority of users?

One more mantra I’ll leave you with has been adopted from many previous writers and thinkers, and for Bitcoiners, it is “Gradually, Then Suddenly”. That’s the assumption that we are still early to the party, and eventually everyone will be on the network, whether they want to or not, and maybe that’s true, but I propose that we need: cultural translators who can speak to real people — without memes, without arrogance, without politics. And, it needs to return to what made it powerful in the first place: transparency, empowerment, resilience.

You can’t fix the protocol, and that's the power of Bitcoin and the strength of the network.

But, we can fix how people encounter it.